Categoria: Bookkeeping

Cash Basis Accounting vs Accrual Accounting Bench Accounting

You will need to determine the best bookkeeping methods and ensure your business model meets government requirements. For instance, certain businesses cannot use cash-basis accounting because of the Tax Reform Act of 1986. However, the cash basis might not always give you a true picture of your financial health. This is because it doesn’t take into account your future financial obligations or potential income. If a client suddenly pays off a large invoice, you may have a lot of cash in your account, making your business look profitable. But if you have a large number of expenses that income has to cover, you’re not as profitable as you seem.

You record income when you earn it and expenses when they are used to produce that income. Accrual accounting gives a more accurate picture of a business’s or law firm’s true financial health over a period of time. The business doesn’t suddenly look healthy because of a sudden influx of cash, or unhealthy because a large expense has been paid for. Rather, the long-term financial activities of the business are taken into account. Under the accrual method of accounting, Company A records an income of $1,000 on March 10th. This was when the order was placed and the contract agreed upon, so early payment discount reasons to offer accounting and more accrual accounting records this as a March transaction even though they won’t receive the money until April.

- More specifically, revenue is recognized as income when you receive payment, and expenses are recognized when money is spent.

- Particularly for small businesses who don’t keep a full-time accountant on staff, cash basis accounting is a simple alternative to more complex systems.

- If a small business is looking to reduce its expenses by managing its own bookkeeping, cash basis accounting may be a helpful option.

- Additionally, cash-basis accounting can make obtaining financing more difficult due to its high probability of inaccuracies.

- With cash basis accounting, your revenue and expenses are recorded when cash is received or paid out, not when invoices are sent.

Choosing the right accounting method

Under cash basis accounting, revenue is reported on the income statement only when cash is received. The cash method is typically used by small businesses and for personal finances. The larger and more complex your business becomes, the more willing you should be to shift to accrual-basis-friendly software and services. For example, Intuit’s QuickBooks Online lets you switch from cash to accrual accounting.

Cash vs. Accrual Accounting: The Bottom Line

If you’re an inventory-heavy business, your accountant will probably recommend you go with the accrual method. You’d record both the expenses and the income in June to line up with when you completed the project and income was earned — even though you weren’t actually paid until July. Now, when you look at your income statement, you can see that the job was actually quite profitable. Under the accrual method, the $5,000 is recorded as revenue as of the day the sale was made, though you may receive the money a few days, weeks, or even months later. If you sell $5,000 worth of machinery, under the cash method, that amount is not recorded in the books until the customer hands you the money or you receive the check. Another disadvantage of the accrual method is that it can be more complicated to use since it’s necessary to account for items like unearned revenue and prepaid expenses.

Business

It also produces a more complete balance sheet that factors in accounts payable, accounts receivable, current assets such as inventory, fixed assets and liabilities like loans. When filing their taxes, the small business might use the cash basis, but use accrual accounting internally to track inventory, giving the owner a more complete picture of the business’s profitability. You can use the blend of cash and accrual accounting methods that works best for your business or law firm. For example, a small business or small law firm might use the cash basis of accounting for routine transactions such as sales transactions and bill payments. This simplifies the daily bookkeeping and gives a clear picture of cash flow and cash available at any given moment.

However, if your business isn’t very complex, you might be able to use the simpler cash accounting method instead. One of the most significant differences between cash and accrual accounting is that each method affects which tax year your income and expenses are recorded in. The cash basis of accounting recognizes revenues when cash is received, and expenses when they are paid.

Cash-Basis vs Accrual Accounting FAQs

For example, under the cash basis method, retailers would look extremely profitable in Q4 as consumers buy for the holiday season. However, they would look unprofitable in the next year’s Q1 as consumer spending declines following the holiday rush. The key advantage of the cash method is its simplicity—it only accounts for cash paid or received. The cash-basis system is not acceptable according to the Generally Accepted Accounting Principles, or GAAP. For companies required to comply with GAAP standards, the accrual-basis method is the preferred form of accounting. If your law firm does not have long payment terms—that is, clients generally pay you immediately—the timing isn’t as much of an issue for your profitability.

Small Business Accounting Software Start for Free

I asked the company for a demo account I could use to test the NetSuite Accounting software and was not granted a testing account. However, NetSuite earns a 4.1 rating on Capterra with 1,458 user reviews and a four out of five-star rating on G2 with 3,080 user reviews. I could star my favorite reports to add to my “favorite reports” list at the top of the page. When I clicked on a report, it was already populated with all my relevant data points.

Intuit QuickBooks

- Enterprise resource planning (ERP) software includes all the features of accounting software, plus additional features such as CRM, inventory management and project management.

- She’s well-versed in the intricacies of LLC formation, business taxes, business loans, registered agents, business licenses and more.

- This individual and their team work with you on customizing your setup and monitoring your transactions so they’re accurate and use the proper category for tax purposes.

- We collect the data for our software ratings from products’ public-facing websites and from company representatives.

- With these always at the top of my screen, I could easily complete key actions.

Unlike data stored on a hard drive, data in the cloud is 8 ways companies cook the books typically not susceptible to being lost due to hardware malfunctions. Finally, find accounting software that integrates seamlessly with other business software. As your company grows, it might be necessary to integrate multiple types of software to scale the business. Sign up for applications that will work seamlessly with your primary business software. Freshbooks also offers a Select plan with specialized features, including a dedicated account manager, but you’ll have to request a demo if you’re interested. In any case, one of its other three paid plans should be a fit for your business needs.

ZarMoney earns a 4.7-star rating on Capterra with 83 user reviews and a 4.8-star rating out of 24 user reviews on G2. Users say the software is easy to use and that customer service is responsive, knowledgeable and caring. They also appreciate how customizable the software features are. However, they also say that accessing the software on mobile devices is extremely difficult and navigating the software menu can be confusing at times. Beyond automation, OneUp showcases flexibility in its approach to client management. It offers two trump’s payroll tax deferral goes into effect distinct operational modes—“Do-It-For-Me” and “I-Do-It-Myself”—allowing businesses to choose the level of control they wish to exert.

Best for Invoicing

Accessing all included tools using the left-hand menu was easy, as it’s a menu that is always present no matter where I navigated on the platform. Once I clicked a menu tab, all the tools I needed to use to complete relevant tasks were included in the resulting page. Would you like to let customers pay with credit cards and bank withdrawals? If so, you need to sign up with a payment processor such as PayPal or Stripe. Of course, this service involves paying transaction fees that can differ slightly from app to app.

But with so many options to choose from, how can you know which one is best for your business? We’ve compiled a list of the best bookkeeping software to help you decide. Tracking accounts payable and accounts receivable, keeping tabs on cash flow, and being ready for tax time are all important for your small business.

Add-Ons and Extras

Its attractive, intuitive UI and exceptional mobile access add to its appeal. Although it’s missing some features that competitors offer and includes some complex language and concepts that rivals keep in the background, it’s still a worthwhile choice for keeping costs down. An intuitive program that gives you access to a simple dashboard that displays charts to provide an how do i cancel a stop payment on a check ach or recurring debit overview of the current state of your company’s finances, automatic features and easy-to-use mobile apps are best.

You’re our first priority.Every time.

Businesses seeking a highly adaptable accounting solution that offers a precise and detailed overview of their finances should consider ZarMoney. In addition, businesses that are likely to increase their accounting software user account in time should consider ZarMoney’s Small Business and Enterprise plans. Xero earns a 4.4-star rating on Capterra and a 4.3-star rating on G2. They appreciate that the software’s automations create business efficiencies.

They also wish they did not have to pay extra for features such as adding team members, saving credit card information or processing payroll. Zoho does offer a forever-free plan as long as revenue falls under the threshold of $50,000 for the fiscal year. FreshBooks was originally engineered as an invoice creation and tracking project to help small businesses and solopreneurs get paid faster. Nearly 20 years after its creation, the accounting software still focuses on helping business owners get paid quickly and accurately.

What is Vertical Analysis? Process & Examples

On both financial statements, percentages are presented for two consecutive years in order for the percent changes over time to be evaluated. For instance, we can see that our company’s long-term debt as a percentage of total assets is 17.0%. We’ve now completed our vertical analysis for our company’s income statement and will move on to the balance sheet. Vertical analysis is a method of financial analysis where each line item is listed as a percentage of a base figure within the statement.

Vertical Analysis of the Balance Sheet

It can be hard to compare the balance sheet of a $1 billion company with that of a $100 billion company. The common-sized accounts of vertical analysis make it possible to compare and contrast numbers of far different magnitudes in a meaningful way. This change could be driven by higher expenses in the production process, or it could represent lower prices.

SaaS Profit and Loss Statement

The formula to perform https://radioshem.net/v-chem-obvinyayut-timura-turlova-i-kompromat-na-ego-deyatelnost.html on the income statement, assuming the base figure is revenue, is as follows. You can compare companies in the same industry by standard comparisons of key line items. By comparing other companies’ percentages against your own, you can understand the strengths, weaknesses, and changes you will need to make. This allows analyzing the composition of the income statement and understand the relative significance of each item in relation to the company’s revenue. In this example, we have expressed each line item as a percentage of the total assets, which serves as the base figure.

What is Vertical Analysis? Process & Examples

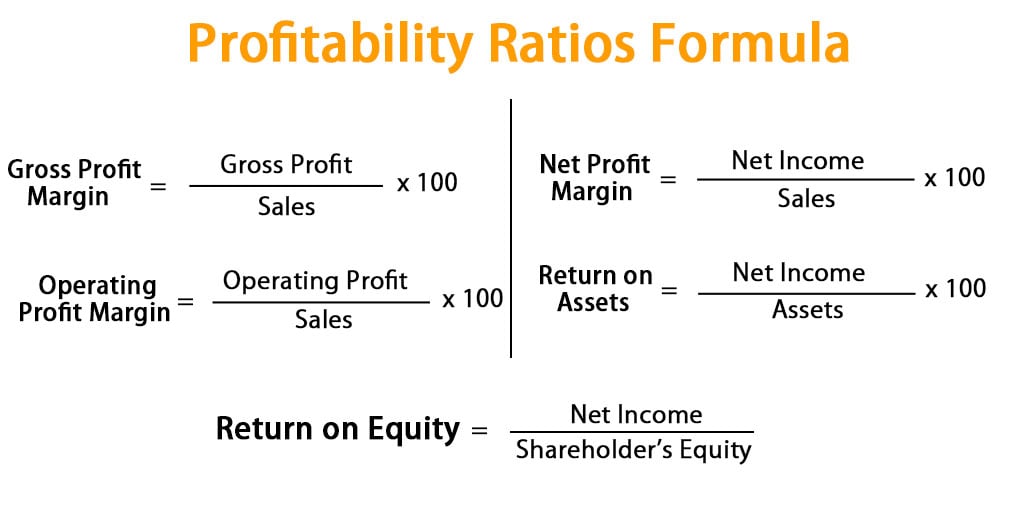

These percentages are considered common-size because they make businesses within industry comparable by taking out fluctuations for size. It is typical for an income statement to use revenue (or sales) as the comparison line item. This means revenue will be set at 100% and all other line items within the income statement will represent a percentage of revenue. Therefore, horizontal analysis looks at changes over time based on different data from the financial statements. By examining these vertical percentages, analysts can evaluate the cost structure, profitability ratios, and the relative significance of different line items within the income statement. By analyzing these ratios using vertical analysis, you can gain insights into a company’s cash flow management and capital allocation strategies.

- If your analysis reveals unusual trends or variances, take the time to investigate these changes.

- It enables businesses to gain quick insights into historical performance by comparing current values to previous periods.

- However, these expenses don’t, at first glance, appear large enough to account for the decline in net income.

- Horizontal analysis, also known as trend analysis, compares historical data on a financial statement over different accounting periods.

- If they were only expecting a 20% increase, they may need to explore this line item further to determine what caused this difference and how to correct it going forward.

Understanding the Impact of Vertical Analysis on Profitability Evaluation

The base may also be net income, total gross income, or any other detail of income that you would want to compare. https://mirkzn.ru/biznes-i-finansy/pochemy-bitkoin-eto-vse-eshe-investicionnaia-vozmojnost-vsei-jizni.html is the comparison of financial statements by representing each line item on the statement as a percentage of the total amount. The following compares the performance of two companies using a vertical analysis on their income statements for 2019.

Using the http://www.all-news.net/accidents/1181751 Calculator, businesses can make informed financial planning and management decisions by evaluating the relative importance of various line items on their financial statements. On the other hand, horizontal analysis looks at changes in specific dollar amounts for each period, highlighting the changes line-by-line over two specific accounting periods. Compares figures from multiple years to identify trends, looking at changes over time in different elements of the financial statements. Accurate and reliable financial statements are essential for conducting effective vertical analysis.

Vertical Analysis of Cash Flow Statement

Vertical analysis is typically used for a single accounting period, whether that’s monthly, quarterly, or annually, and can be particularly helpful when used to compare data for several accounting periods. For example, if Mistborn Trading set total assets as the base amount and wanted to see what percentage of total assets were made up of cash in the current year, the following calculation would occur. Normally, if you were comparing retail or manufacturing companies, you would be more interested in profits from operations, since that is the core business function.

What is Vertical Analysis Formula?

We can’t know for sure without hearing from the company’s management, but with this vertical analysis we can clearly and quickly see that ABC Company’s cost of goods sold and gross profits are a big issue. By doing this, we’ll build a new income statement that shows each account as a percentage of the sales for that year. As an example, in year one we’ll divide the company’s “Salaries” expense, $95,000 by its sales for that year, $400,000. That result, 24%, will appear on the vertical analysis table beside Salaries for year one.

GPAnalysis, comic book tracking, comic book sales CGC

Miranda began her career in the insurance industry with a mid-sized independent insurance agency. She has been instrumental in assisting senior management with agency acquisitions, data migration projects, and building custom reports. She has been beneficial in creating efficiencies within agency work by developing and implementing agency workflows, procedural documentation, and training of agency employees. Miranda was active and served on the Board in her local NetVu Chapter for many years.

- In this guide we’ll show you how you can quickly and easily create a gross profit analysis report inside growyze, showing sales data, expected gross profit and variances between your figures.

- We also add Yahoo auctions, although there are very few each week (occassionally an important book gets sold through their auction site, so it’s worth tracking).

- Also, the broad scope of this list of events should make it clear that controlling gross margin requires the input of many parts of a business, including the engineering, materials management, sales, and production departments.

- Then, our experts curated a large selection of Microsoft Office, leadership, and sales classes to include that are ideal for agency personnel.

- It is not surprising to see Amazing Spider-Man #300 on the GPA Top Individual Comic Volume Report, since more CGC graded copies exist for this comic than any other.

- Margaret served on several Company committees, was an active member in the Red River Users Group and a member of the AMS360 NetVU Education Committee.

Blissard Comics

In this guide we’ll show you how you can quickly and easily create a gross profit analysis report inside growyze, showing sales data, expected gross profit and variances between your figures. A higher gross profit margin indicates a more profitable and efficient company. However, comparing companies’ margins within the same industry is essential, as this allows for a fair assessment due to similar operational variables. Going live soon after the advent of the Certified Guaranty Company, GPA for CGC Comics has offered comic book collectors a daily updated, online tracking service for more than eight years. Notice that in terms of dollar amount, gross profit is higher in Year 2.

Pioneered Remote Accounting

In simple terms, gross profit margin shows the money a company makes after accounting for its business costs. This metric is usually expressed as a percentage of sales, also known as the gross margin ratio. A typical profit margin falls between 5% and 10%, but it varies widely by industry. Unlike comic books, CGC began grading issues of Playboy magazine in 2009, and the 15% calculation for the prior twelve months is not comparable to one-twentieth of the CGC Census (as it would be for a comic book). Instead, approximately 8% of all CGC graded copies of Playboy #1 were graded in the prior twelve months, so the 15% of the whole CGC Census recorded as GPA sales is approximately twice as many copies as the CGC Census increase. Sports Illustrated #1 (1954) is comparable with a CGC Census % of 11% over the same period of time.

Manage Your Collection

Companies strive for high gross profit margins, as they indicate greater degrees of profitability. When a company has a higher profit margin, it means that it operates efficiently. It can keep itself at this level as long as its operating expenses remain in check. To calculate download turbotax amendment software to amend your 2019 tax return operating profit margin, subtract the cost of goods sold (COGS), operating expenses, depreciation, and amortization from total revenue. You then express the result as a percentage by dividing by total revenue and multiplying by 100, similar to gross and net profit margins.

Operating Profit Margin

Check out our free online comic price guide if you’re looking to sell your comic book collection. Our tool will give you an estimate of what you can expect, and our experts will take it from there. Our experts have been in the field for a while — we know what to look out for. GPAnalysis is a website that has been recording CGC certified sales from eBay, Heritage Comics, and some of the largest comic dealers on the internet since 2002.

However, high prices may reduce market share if fewer customers buy the product. This can be a delicate balancing act, requiring careful management to avoid losing customers while maintaining profitability. Because the volumes (number of sales) for each individual comic (and some non-comics) determines the Top 20 lists in the GPA Individual Comic Volumes reports, the number of sales are not comparable across the eras. The top volume for Modern is 2,741 sales in the prior twelve months, while the top volume for Silver is 481, and these are not a “fair comparison” due to the numbers of copies that exist for these books.

The Agency Coaches work closely with owners and senior managers to keep them out of the weeds and laser-focused on goals. To calculate a company’s net profit margin, subtract the COGS, operating expenses, other expenses, interest, and taxes from its revenue. Then, divide this figure by the total revenue for the period and multiply by 100 to get the percentage.

Her key to success is her thorough knowledge of the system and what it can do for you in cutting cost and improving efficiencies as well as employee satisfaction. “They,” said agencies would never want someone in their books… But Angela knew that agencies needed expert guidance and support. She knew the agency owners who spent more time developing their team, nurturing client relationships, and growing their business were more successful. Today, hundreds of agency owners are still confident in their finances due to remote Accounting Solutions by Angela Adams Consulting.

Organizational Structures for All Sizes of Accounting Firms

SMEs often face resource constraints and must carefully allocate funds to achieve their business goals. SMEs can harness strategic advantages by effectively fostering interactions within their strategic approach to sustain the quality of work and achieve a competitive advantage (Sherani et al., 2022; Muna et al., 2022). Thus, SMEs must make the necessary investments to ensure they have the necessary tools and resources to align external and internal perspectives, leading to accomplishing strategic objectives. Many SMEs nowadays consider investing in various strategic directions that include information technology and the ability to add value. The restricted adoption of strategies by SME owners and managers may not yield favorable returns, often due to the lack of time available for adequately evaluating strategic opportunities (Kumar et al., 2023). The key factor determining success or hindrance is executing strategies primarily guided by customer needs (Monroy-Gomez et al., 2022).

Understand the CFO role: Key responsibilities and essential skills

- A key aspect of your CFO’s role in business growth is integrating financial expertise with overall business strategy.

- The questionnaire was tested through a pilot study using 37 participants to enhance the response rate and understanding (Johanson and Brooks, 2010).

- Your accounting workflows will be enabled to be quick and seamless without the need to rethink your accounting practice management software or internal processes.

- But for a scaling company, hiring a CFO is a critical investment to help get them to the next level.

Letting someone else handle your accounting means you have one less thing to worry about. Instead of crunching numbers, you’ll be free to focus on other tasks that are necessary to run or scale your business. An accountant can also ensure greater accuracy and may be more knowledgeable about the tax code and reporting requirements. There are numerous software options for small businesses, with QuickBooks and FreshBooks being two of the most popular. When deciding which software program to use for accounting, it helps to first consider what your business needs.

How the Big Four Accounting Firms Are Typically Structured

The consulting department offers strategic and operational advice to clients. Lastly, the advisory department provides risk management, IT advisory, and financial advisory services. The organizational structure of the Big Four accounting firms is typically hierarchical and follows a partner-led model. Partners are the highest-ranking individuals within the firm and are responsible for managing client relationships, leading teams, medium business accounting and making strategic decisions. MD Accountants & Auditors Inc, owned and run by Alexis Sacks and Dave Rich, is a multi-disciplinary firm of registered auditors and business advisors based on the Kenilworth Race Course in Cape Town. Since 1997 their aim has been to provide objective and professional business advisory services to private and corporate clients, with particular regard to financial planning and corporate requirements.

Accounting for Small Businesses: A Comprehensive Guide to Financial Management

In this quantitative study, 450 self-administered questionnaires were distributed to the managers and owners of SMEs using purposive sampling. Data were analyzed using the structural equation modeling (SEM) method via SmartPLS3 Software. The study offers empirical findings on the importance of AIS as a mediator, considers various factors, and provides clear strategies for better work performance. The study confirmed that the SMEs’ strategy and the use of an AIS significantly and positively affected SMEs’ organizational performance, while AIS use partially mediated between SMEs’ strategy and organizational performance. AIS can support organizational performance through an SME strategy, avoid human errors, provide cost-against-time savings, and assist in timely internal decision-making considering long-term benefits.

How to Stay Organized Regardless of Your Business Structure

The sectors included in the study scope are defined as technical, professional, agriculture, artisanal work, construction, trade, transportation and storage, automotive repair and maintenance, and others. The target population was managers and owners of SMEs in Basra governorate in the south of Iraq. Remember that the key to a successful accounting firm structure is to ensure it aligns with your firm’s unique needs and strategic goals. Choosing the best business structure for accounting firms will depend on your accounting firm’s size. It would help if you considered redesigning your accounting firm structure whenever there is a change to your strategic vision, long-term goals, internal processes or accounting services. Partners typically receive support from a large pool of senior managers, managers, and staff members.

Sample and data collection

- Therefore, SMEs must consider various factors that can help eliminate regulatory and practical obstacles to facilitate business or expand within the market.

- Embracing accounting practice management software can support your new accounting firm structure by streamlining operations and processes and increasing productivity.

- All authors participated in writing and revising the manuscript and approved the final manuscript.

- This type of questionnaire is ideal for collecting quantitative data, making analysis more straightforward, reducing measurement error and respondent bias, and making answering and quantification faster.

- Remember, there is no one-size-fits-all approach to accounting firm structures.

Unsurprisingly, the biggest international clients and richest individuals go to Big 4 firms for their accounting needs. Thus, you’ll work with slightly smaller clients at mid-tier firms, although they may still be international companies. Additionally, since fewer employees are at a mid-tier firm, you’ll be called on to fill more roles and thus gain a broader range of experience.

related articles you may like.

Prepaid Expenses in Balance Sheet: Definition, Journal Entry and Examples

When an organization makes a large payment that covers several months, it could be considered a remeasurement of the Lease Liability and ROU Asset and should be accounted for as such. In this case one asset (pre paid rent) has been increased by 3,000 and the other (cash) has been reduced by a similar amount. Ultimately, by the end of the subscription term, both the long-term and short-term portions of the prepaid subscription account balances will be zero.

Rent Accounting for ASC 842: Prepaid Rent, Journal Entries, and More

Prepaid expenses aren’t included in the income statement per generally accepted accounting principles (GAAP). In particular, the GAAP matching principle requires accrual accounting, which stipulates that revenue and expenses must be reported in the period that the spending occurs, not when cash or money exchanges hands. In this example, let’s assume we purchase a 12-month cyber insurance policy for $1,800 on January 1st, 2023.

Order to Cash

- However, under ASC 842, the new lease accounting standard, prepaid rent is now included in the measurement of the ROU asset.

- Tell the Clerk or Judge if you are in the military or dependent on someone in the military.

- The asset is amortized as it is gradually utilized, and the prepaid expense eventually decreases to zero.

- Common examples of prepaid expenses include leases, rent, legal retainers, advertising costs, estimated taxes, insurance, salaries, and leased office equipment.

- The company can make the prepaid rent journal entry by debiting the prepaid rent account and crediting the cash account after making the advance payment for the rent of facility.

- Organizations may have a commercial leasing arrangement or a rental agreement.

- All journal entries applicable to this scenario are illustrated in detail below.

If the landlord changes your locks without a court order it is a crime, call the police, 911. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Prepaid Rent Accounting Entry

With the transition to ASC 842 under US GAAP, some of the terminology and accounting treatments related to rent expense are changing. If the lease agreement defines the rent payments as contingent upon a performance or usage but also includes a minimum threshold, the minimum is used in the calculation of the lease liability. Because of the inclusion of the minimum threshold, the lessee has a commitment to pay at least the lower amount regardless of actual performance or usage. While some variability exists in the outcome of the calculation, the minimum amount is fixed. Current assets are assets that a company plans to use or sell within a year; they are short-term assets. If any prepaid expense will not be used within a year, then it must be recorded as a long-term asset.

- In the 12th month, the final $10,000 will be fully expensed and the prepaid account will be zero.

- If the Judge signs the Order to Show Cause with a stay of the eviction, this will stop the eviction after you deliver the court papers to the landlord until you come back to court on the new court date.

- The current ratio is a useful liquidity metric to evaluate whether a company can meet its short-term obligations by utilizing assets which can quickly be converted into cash.

- We can see below that Hershey’s in their consolidated balance sheet for 2023 has recognized a prepaid expense of $345,588 under assets.

- Under ASC 842, prepaid rent is now included in the ROU asset instead of being accounted for in a separate Balance Sheet account.

Due to the nature of certain goods and services, prepaid expenses will always exist. For example, insurance is a prepaid expense because the purpose of purchasing insurance is to buy proactive protection in case something unfortunate happens in the future. Clearly, no insurance company would sell insurance that covers an unfortunate event after the fact, so insurance expenses must be prepaid by businesses. Deferred rent is a liability prepaid rent meaning (or an asset) that results from the difference between the actual payment to the lessor and the straight-line expense recorded on the lessee’s statements. At transition to ASC 842, deferred rent is included as part of the ROU Asset balance.

Accounts Receivable Aging Report: Importance, How to Create &Use It?

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

- The expense for the first two months has been incurred because the company has used the rented equipment or occupied the leased space, but cash for these services has not been paid.

- By the end of the lease, the balance in the deferred rent account will be zero.

- Additionally, deferred rent is also recorded for lease agreements with escalating or de-escalating payment schedules.

- Factors include things like, serious ill health, or how it would effect your child to change schools.

Accounting for deferred rent with journal entries

Interest paid in advance may arise as a company makes a payment ahead of the due date. Meanwhile, some companies pay taxes before they are due, such as an estimated tax payment based on what might come due in the future. Other less common prepaid expenses might include equipment rental or utilities.

Further details on the treatment of pre paid rent can be found in our prepaid expenses tutorial. This journal would be repeated at the end of May and June until the pre paid rent of 3,000 has been charged as an expense to the income statement and the pre paid rent account balance has been reduced to zero. At the lease’s end, the Lease Liability and Right-of-use (ROU) Asset account have both been reduced to zero. The lease expenses for each year are $36,721, which perfectly reflects the payment made every year (even if Year 1 was prepaid). As we already prepaid the Year 1 rent, there won’t be a reduction to lease liability (remember – the beginning lease liability excluded that).

Lease Commencement Date and Start Date for US GAAP Accounting Explained

A full example with journal entries of accounting for an operating lease under ASC 842 can be found here. As per the QuickBooks accounting principle of GAAP, prepaid expenses are not initially included in the income statement as they are not incurred. As prepaid assets start getting used over time, they are expensed on the income statement.

Willkommen im deutschen Online-Shop für hochwertige Replica-Uhren, um die besten Replik-Uhren in Deutschland zu kaufen.

Residual Income Valuation

And although it may be risky when establishing the mechanism for passive income, it also offers increasing levels of financial security. If you decide to buy your leased car, the price is the residual value plus any fees. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

It is the amount of money you generate (or plan to how to keep accounting records for a small restaurant chron com generate in the future) from passive sources such as dividends and interest. If you are applying for a loan, your residual income is the amount of money you have to spend after all of your monthly obligations have been paid. Residual value also figures into a company’s calculation of depreciation or amortization.

Jim’s furniture manufacturer builds tables and has several large pieces of equipment in the sawmill used to re-saw logs and boards down to the finished dimensions. The saws in the mill cost Jim a total of $500,000 and he is currently earning a return of 10% in his wholesale table business. Simply put, the residual income is the net profit that’s been altered depending on the cost of equity. The equity charge is computed by multiplying the cost of equity and the company’s equity capital. Residual income is calculated as net income less a charge for the cost of capital.

Passive Income

Using the example of leasing a car, the residual value would be a car’s estimated worth at the end of its lease term. Residual value is used to determine the monthly payment amount for a lease and the price the person holding the lease would have to pay to purchase the car at the end of the lease. If you lease a car for three years, its residual value is how much it is worth after three years. The residual value is determined by the bank that issues the lease, and it is based on past models and future predictions. Along with interest rate and tax, the residual value is an important factor in determining the car’s monthly lease payments. If you’re able to take on a part-time side hustle, these extra earnings could increase your residual income.

This information is helpful to management to know how much cash flow it may receive if it were to sell the desk at the end of its useful life. Understanding residual income, sometimes called discretionary or disposable income, can help you manage your cash flow. And you can use this leftover income to invest, save, pay off debt or splurge on things like a vacation. Building residual income can give you peace of mind about your finances. The residual income business calculation allows management to easily identify whether an investment center is meeting its minimums. If the RI positive, the department is making more than its minimum.

When looking at corporate finance, residual income is any excess that an investment earns relative to the opportunity cost of capital that was used. Residual income broadly speaking is a measurement of tangential profits earned after subtracting all costs of capital related to generating that income. Other terms for residual income include economic value-added, economic profit, and abnormal earnings. You can generate passive income from renting out your property for long-term or short-term leases. And the passive income you generate from rental property could increase your residual income. If you own your property outright, renting it out can be even more profitable.

Stock Valuation

Suppose a company acquires a new software program to track sales orders internally. This software has an initial value of $10,000 and a useful life of five years. To calculate yearly amortization for accounting purposes, the owner needs the software’s residual value, or what it is worth at the end of the five years.

How to build your residual income

- Given the opportunity cost of equity, a company can have positive net income but negative residual income.

- You might have seen the term “passive income” used interchangeably with “residual income.” But this article will use these two terms differently.

- This means Jim’s mill is making more than the minimum 10 percent required and way more than the wholesale business.

Take your learning and productivity to the next level with our Premium Templates.

What is a Good Residual Income?

You could use passive income streams to increase your monthly residual income. But residual income may not always come from passive income sources. One example of passive income is the profit realized from a rental property owned by investors who are not actively involved in managing it. Another example is a dividend-producing stock that pays an annual percentage. While an investor must purchase the stock to realize the passive income, no other effort is required. If you are planning your long-term future, residual income takes on a different meaning.

Management must periodically reevaluate the estimated value of the asset as asset deterioration, obsolescence, or changes in market preference may reduce the salvage value. In addition, the cost to dispose of the asset may become more expensive over time due to government regulation or inflation. In accounting, owner’s equity is the residual net assets after the deduction of liabilities. In the field of mathematics, specifically in regression analysis, the residual value is found by subtracting the predicted value from the observed or measured value. You can create residual income by selling unused items through online and app-based marketplaces. One of the most straightforward ways to build your residual income is to increase the income from your full-time work.

The resulting figure is $80k, which represents the project’s residual income. Because this figure is positive, it suggests the project should likely be approved. For purposes of decision-making under the context of capital budgeting, the general rule is to accept a project if the implied residual income is greater than zero.

What is residual income?

When there’s a positive RI, it means the company exceeded its minimal rate of return. On the contrary, a negative RI means it failed to meet the projected rate of return. However, in the context of equity valuation, residual income refers to the net income after accounting for all the stockholders’ opportunity cost in generating that income.

The final step is to subtract the target (desired) income amount from the project’s operating income ($125k). It requires an upfront investment of money, hard work, or sweat equity. But once that work is completed, a stream of income reversing entries has been established that takes little or no effort to maintain.

Best replica watches uk for sale, super fake rolex watches knockoff online with cheap price wholesale.

Acquista i migliori orologi replica di lusso su https://orologireplica.is offre orologi replica di Rolex, Panerai, Tag Heuer, Omega e altri a prezzi bassi.

At nursewatches.co.uk the High-Quality replica watches for the best price on fake watch website.

What Is a Clearing Account in Accounting?

In your accounting software, a checking account is your current bank account that you connect to the accounting system and use for money transfers and reconciliation. The money gets transferred from the customer’s Stripe account to yours and is kept there for some time. You can’t see them on your real bank account or manage this money for a moment. Typically, companies with a high volume of funds coming in or going out use clearing accounts.

How e-Commerce Businesses Benefit From Using Clearing Accounts

Yes, clearing accounts offer flexibility for making adjustments or corrections to sales tax records, enabling businesses to rectify errors promptly without affecting other financial accounts. You may also have a payroll clearing account in your books where you record payments until you see the payments clear your bank. Once all employees cash or deposit their checks, move the funds from the clearing account to the appropriate account in your books (e.g., Payroll Expense). The accounts payable team uses calculating net operating income noi for investment property this account to hold funds necessary for paying incoming invoices. Liability clearing accounts can hold these funds before receiving the invoices or processing payment. Some businesses use this account to keep partial savings toward an upcoming lump sum payment for a bill or big purchase.

What is a Clearing Account in Closing the Books?

After the account is created, it is crucial to establish internal controls and procedures for its use. This includes defining who has access to the account, what types of transactions can be recorded, and how often the account should be reviewed and reconciled. Clear guidelines help prevent misuse and ensure that the account serves its intended purpose effectively. Training staff on these procedures is equally important, as it ensures consistency and accuracy in how the account is managed.

Bank accounts are monetary repositories maintained by a financial institution. Welcome to Learn, where we provide straightforward, easy-to-understand definitions of the payments industry. Then get comfortable, and we’ll tell you everything step by step, but briefly. Most of the checks the Federal Reserve Banks receives are collected and settled within one business day. Clearing is necessary for the matching of all buy and sell orders in the market.

Given that it serves as a holding area for all transactions, it is easy to spot anomalies that could indicate fraud or inaccuracies. Get granular visibility into your accounting process to take full control all the way from transaction recording to financial reporting. As the payment has been matched with the corresponding invoice, the payment is moved to the company’s cash account.

Common Uses in Financial Management

Open “lists,” then select “Chart of Accounts” and right-click anywhere in here, then select “new.” There should now be an “add new account” window, so select the “bank” button. Quickbook notes that there are several account types to choose, but “bank” is the best for a clearing account because of the flexibility it offers. Where they differ is that a suspense account is all about solving a mystery or problem. Perhaps some client has paid off several things at once in some lump sum and there’s some struggle in deciphering how that payment breaks down.

Clearing accounts can sometimes be confused with “suspense accounts” – understandable since they’re both temporary accounts waiting for more information before a next step can happen. If funds remain in a clearing account for an extended period, it can lead to discrepancies in financial reporting and inaccurate financial statements. It’s important to investigate and resolve any outstanding items promptly. Synder automation software uses the flow with a clearing account instead of just syncing deposits to a checking account. This achieves a high level of accuracy in reconciliation and makes the process easier. In Synder, transactions from the clearing account go to your checking account.

Clearing accounts provide a central location for all related transactions, so businesses can quickly and accurately reconcile their balance sheets. Furthermore, the Reconciliation Control Tower from Highradius offers a centralized platform to manage and monitor the reconciliation process. This tool provides real-time visibility into the status of reconciliations, enabling businesses to identify and address discrepancies quickly. Synder creates clearing accounts in your QuickBooks or Xero accounting system that reproduces the real money flows from any payment gateway. Accountants use clearing accounts to store money-in and money-out information for a short period of time until everything is ready to be officially registered in the permanent records. Because you received a partial payment without an invoice, create an asset clearing account in your general ledger to record the payment.

For example, an account with revenue and expense amounts that are to be transferred to retained earnings at the close of a fiscal period. Sometimes there is a need for a safe buffer space for different types of transactions that have not yet taken place or require some type of specific detailing or processing. As a hypothetical example, assume that one trader buys an index futures contract. This amount is held as a “good faith” assurance that the trader can afford the trade.

This money is held by the clearing firm, within the trader’s account, and can’t be used for other trades. Virtual accounts are unique account numbers assigned within traditional, physical bank accounts, which are also known as settlement accounts. They can be used to send and receive money on behalf of the settlement account. Clearing accounts can be set up to clear daily, monthly, or at the end of the fiscal year. Clearing happens via ACH technology, automatically transferring the funds to another count, rendering the balance zero.

- They may park revenue and costs related to this project in the temporary or clearing account until the review is complete.

- The process of clearing ensures that the entities or parties engaged in a financial transaction are protected, receive their due amount, and the transaction goes smoothly.

- Clearing accounts help manage cash flow by providing a clear picture of pending transactions.

- Clear guidelines help prevent misuse and ensure that the account serves its intended purpose effectively.

In this blog, you’ll explore the clearing accounts definition, its main purposes, and how it works. By the end, you’ll have a clear understanding of why clearing accounts are vital in financial management. Ultimately, clearing accounts can be a tremendous tool for many companies. Whether clearing accounts are beneficial for your firm comes down to the volume of transactions and how many hands are involved in the corporate accounting. If you’ve sought better transparency and cleaner accounting ledgers, clearing accounts could be the solution you’re after.

For instance, in construction or manufacturing, where projects involve numerous transactions over extended periods, clearing accounts can be used to aggregate costs and revenues temporarily. This allows project managers to track financial performance do i need to file a tax return for an llc with no activity more effectively and make informed decisions based on real-time data. By consolidating transactions in a clearing account, organizations can also streamline their financial reporting, making it easier to present a comprehensive view of project finances to stakeholders. They are meant to be temporary holding accounts, and it’s essential to reconcile and clear them regularly to maintain accurate financial records. A clearing account helps businesses and accountants temporarily record financial transaction details.

You can buy best replica rolex Submariner on www.rolexreplicaswissmade.com/Watches/Submariner.php

6 Best Online Accounting Firms for Small Business of 2023

You need to keep your clients who are business owners up-to-date on the state of their business, and you need them to provide you with details in a timely manner. It can be tempting to load up on tons of shiny apps, but it will serve your firm and your clients best to focus on just a few that get the job done. InDinero also offers seamless integration with both QuickBooks and NetSuite. Running a successful nonprofit or small business requires a great deal of time, effort, and resources.

Best for Bookkeeping Services

That’s about average for all occupations, but accounting tends to be an extremely stable career as well. According to AccountingWEB, during recessions, unemployment rates for accountants are usually lower than those for other workers. Once you start getting good results for a client, ask for a review and—this is key—make it easy for them. Make the ask royalties in accounting in writing and include a link directly to the review page on whatever platform you’re targeting.

Marketing Your Virtual Accounting Services

Virtual, outsourced, and online are often used interchangeably when referring to bookkeeping and accounting. However, a virtual bookkeeper or virtual accountant can sometimes refer to accountants or CPAs who work out of their homes and contract out their services individually. In contrast, outsourced bookkeeping and accounting nearly always refers to accountants with an accounting firm who handle your books from their own office. Along with offering the typical outsourced bookkeeping services, AccountingDepartment.com provides outsourced director of development, new england sos controller services. With this service, their CPAs manage bookkeeping while also budgeting, forecasting, doing job costing, managing cash flow, tracking inventory, and performing other financial management tasks on your behalf.

- And the Executive plan, which is built for larger companies that need CFO services, has custom pricing.

- However, if you’re looking for the best all-around accounting firm, you can’t go wrong with indinero for its comprehensive offering, excellent customer support, and reasonable pricing.

- One of the first things you’ll need is a set of communication guidelines for everyone in the firm to follow.

- The growth of your virtual accounting firm should coincide with an expansion of your service offerings.

- Shareable online calendars reduce the back-and-forth of scheduling meetings.

How Much Does a Virtual Accountant Make?

Typically, the lower your expenses (and the fewer your accounting needs), the less you’ll be charged. With Bookkeeper360, you’ll get a dedicated virtual accountant who sends detailed reports on a monthly basis. Beyond accounting and bookkeeping, offering advisory and consulting services can add more value to your clients. These services can help your clients make informed financial decisions and grow their businesses. Remember, your role as an accountant isn’t just about number crunching. However, the accounting profession is moving away from charging by the hour in favor of subscription pricing.

This happens when performing the functions in-house interferes with essential business growth activities. Every hour you spend on bookkeeping or accounting is one less hour spent marketing your business, building client relationships, and other business development activities. At some point, the cost to your business in terms of lost growth opportunities becomes immeasurable. The virtual bookkeeping providers above might be our favorite—but if they don’t quite fit your needs, we understand completely. Here are three other online accounting service providers worth looking at.

Our expert tax report highlights the important issues that tax preparers and their clients need to address for the 2024 tax year. Stay informed and proactive with guidance on critical tax considerations before year-end. Don’t start your day reading email for hours, because your day can quickly unravel. “When you wake up, center yourself, do deep breathing, and think about what your priorities for the day are going to be,” Bhargava advised. If you still want to check email first thing during your morning cup of coffee, then cap it to an hour.

Investopedia narrowed the wide array of providers down to 20 and evaluated them on services offered, cost, ease of use, and other factors to arrive at the five firms highlighted here. what is a stale check Bookkeeper.com’s cheapest virtual bookkeeping service starts with bookkeeping basics, like preparing key financial statements. From there, you can add comprehensive accounting, payroll, and tax services as needed.

What Our Clients Say

They don’t take much ongoing effort, so make sure you get them set up right away. Our firm has weekly update meetings on Mondays and we take turns presenting biweekly lunch-and-learns. You may just need one weekly meeting or multiple stand-ups throughout the week. To keep everything running smoothly, you’ll need to create an effective system for workflow and maintaining company culture. You can also reduce the need for meetings altogether by providing information in a more asynchronous way.

This consultation serves as a foundation for establishing a strong working relationship and setting clear expectations. Virtual CPA services provide access to a team of highly skilled professionals with specialized knowledge in nonprofit and small business accounting. These experts understand the unique financial challenges faced by an organization and can offer tailored solutions and insights. By tapping into this wealth of expertise, organizations can make informed financial decisions, optimize their financial performance, and navigate complex regulations with confidence. Many firms that charge a flat monthly fee also offer tax filing services for an extra fixed annual fee in the range of $750 to $900. For businesses on a growth track, the cost of not outsourcing bookkeeping and accounting can be detrimental to the business.

Hypertension: How just 1 alcohol drink a day may affect blood pressure

Read on to learn more about alcohol and blood pressure, as well as what drinks may benefit a person who has hypertension and when to talk with a doctor. Being overweight also can cause disrupted breathing while you sleep, a condition called sleep apnea. To prevent various health complications, including high blood pressure, people should try to limit their alcohol consumption to one or two glasses infrequently.

Benefits Recommended For You

When you overindulge in alcohol, your liver, which is responsible for breaking down toxins like alcohol, can become overworked, explains Andrews. This may lead to fat buildup, inflammation and, eventually, scarring of liver tissue. “Over time, this repeated damage can result in cirrhosis, where the liver becomes so scarred that it loses functionality,” she explains.

Researchers

- Binge drinking over and over can cause long-term rises in blood pressure.

- We are moderately certain that medium‐dose alcohol decreased blood pressure and increased heart rate within six hours of consumption.

- “As you grow older, health problems or prescribed medicines may require that you drink less alcohol or avoid it completely,” the Institute says.

- Kimberly Goad is a New York-based journalist who has covered health for some of the nation’s top consumer publications.

- It’s important to note that some studies examined only looked at small numbers of females compared to males.

There is no singular recommended level of alcohol for people who have high blood pressure aside from reducing your intake as much as possible. One of the most appropriate ways to reduce alcohol-induced high blood pressure is to reduce your alcohol intake as much as possible. For example, some people who intake a large amount of alcohol may not show signs of high blood pressure. On the other hand, even people who do not drink can develop high blood pressure for other reasons. However, other research also suggests that alcohol increases blood pressure.

Top doctors in ,

Blood Pressure Categories Infographic describing the corresponding blood pressure readings between normal and hypertensive crisis. The American Heart Association is a relentless force for a world of longer, healthier lives. We are dedicated to ensuring equitable health in all communities. Through collaboration with numerous organizations, and powered by millions of volunteers, we fund innovative research, advocate for the public’s health and share lifesaving resources. does alcohol drop blood pressure The Dallas-based organization has been a leading source of health information for nearly a century. Connect with us on heart.org, Facebook, Twitter or by calling AHA-USA1.

But lifestyle changes play a vital role in treating high blood pressure. Controlling blood pressure with a healthy lifestyle might prevent, delay or lessen the need for medicine. Alcohol increases the risk of several other short- and long-term health issues.

- Additionally, drinking excessively has been shown to increase the risk of accidents and injuries.

- Revenues from pharmaceutical and biotech companies, device manufacturers and health insurance providers and the Association’s overall financial information are available here.

- For example, alcohol can affect calcium levels, cortisol levels, and baroreceptor sensitivity, all of which can lead to increases in blood pressure.

Routinely drinking alcohol may raise blood pressure even in adults without hypertension

Studies have shown that a good percentage of people who drink alcohol also smoke, which can raise blood pressure as well. The AHA states even people who drink one alcoholic beverage per day showed a link to higher blood pressure compared to non-drinkers. That said, if you have specific concerns about your blood pressure and heart health, or feel that your drinking habits have a negative effect on your health and well-being, it’s always a good idea to let your doctor know. “Limiting or completely quitting drinking can lead to improvements in your blood pressure, especially if you’re a regular or heavy drinker,” says Sheth. This is when experimenting with different mocktail recipes, or choosing nonalcoholic drinks when you go out, can be fun and helpful.

- Read more about the causes and risk factors of high blood pressure.

- This article will discuss the various causes of sudden hypotension and how a sudden drop in blood pressure is diagnosed and treated.

- The source of funding was not reported for a majority of the studies.

- You can measure your blood pressure at home to help make sure that your medicines and lifestyle changes are working.