Categoria: Bookkeeping

Quick Ratio Explained: a Key Financial Metric

The Quick Ratio, also known as the Acid-test or Liquidity ratio, measures the ability temporary and permanent accounts of a business to pay its short-term liabilities by having assets that are readily convertible into cash. These assets are, namely, cash, marketable securities, and accounts receivable. These assets are known as “quick” assets since they can quickly be converted into cash. Investors who are looking to perform in-depth assessments of companies can benefit from comparing liquidity metrics in financial analysis. The quick ratio, current ratio, and cash ratio can all be used to measure this kind of financial health.

The quick ratio is an indicator of a company’s short-term liquidity position and measures a company’s ability to meet its short-term obligations with its most liquid assets. By excluding inventory, and other less liquid assets, the quick ratio focuses on the company’s more liquid assets. The current ratio also includes less liquid assets such as inventories and other current assets such as prepaid expenses. If a company’s financials don’t provide a breakdown of its quick assets, you can still calculate the quick ratio. You can subtract inventory and current prepaid assets from current assets, and divide that difference by current liabilities.

Current Ratio Formula

For example, a company can have a huge amount of accounts receivable that will eventually cause a higher quick ratio. Small businesses are prone to unexpected financial hits that can disrupt cash flow. If there’s a cash shortage, you may have to dig into your personal funds to pay employees, lenders, and bills. The quick ratio may also be more appropriate for industries where inventory faces obsolescence.

- Quick Ratios are essential financial metrics that help businesses gauge their short-term liquidity and ability to meet immediate financial obligations.

- Cash equivalents are often an extension of cash, as this account often houses investments with very low risk and high liquidity.

- There are also considerations to make regarding the true liquidity of accounts receivable as well as marketable securities in some situations.

- The quick ratio is a more appropriate metric to use when working or analyzing a shorter time frame.

While a high quick ratio is generally viewed positively, a ratio that is too high may point to a company that is not using its resources effectively. Quick ratios can vary significantly between different industries, which is why some recommend using this measure to compare companies within the same industry. In a publication by the American Institute of Certified Public Accountants (AICPA), digital assets such as cryptocurrency or digital tokens may not be reported as cash or cash equivalents. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining supplemental payments to its advisory services, together with access to additional investment-related information, publications, and links.

To Ensure One Vote Per Person, Please Include the Following Info

As an investor, you can use the quick ratio to determine if a company is financially healthy. “The higher the ratio result, the better a company’s liquidity and financial health is,” says Feldman. Conversely, the current ratio factors in all of a company’s assets, not just liquid assets in its calculation. That’s why the quick ratio excludes inventory because it takes time to liquidate. A company’s quick ratio is a measure of liquidity used to evaluate its capacity to meet short-term liabilities using its most-liquid assets. A company with a high quick ratio can meet its current obligations and still have some liquid assets remaining.

Why Is the Quick Ratio Better than the Current Ratio?

This suggests that the start-up is in a robust liquidity position, which can enhance its credibility among investors and potential partners. Each type of Quick Ratio serves a specific purpose and provides different insights into a company’s liquidity position. Companies and investors may choose to use different versions of the Quick Ratio based on their risk tolerance, industry, and specific financial analysis needs. The choice of which Quick Ratio to use depends on the level of conservatism required and the financial context in which it is being applied. The Cash Ratio is the most stringent version of the Quick Ratio, focusing solely on the most liquid asset – cash and cash equivalents – to measure a company’s ability to pay off its current liabilities. It indicates if a business can meet its current obligations without experiencing financial strain.

The current ratio does not inform companies of items that may be difficult to liquidate. It may not be feasible to consider this when factoring in true liquidity, as this amount of capital may not be refundable and already committed. Most often, companies may not face imminent capital constraints, or they may be able to raise investment funds to meet certain requirements without having to tap operational funds. Therefore, the current ratio may more reasonably demonstrate what resources are available over the subsequent year compared to the upcoming 12 months of liabilities. Cash equivalents are assets that can be quickly converted into cash, such as short-term investments or accounts receivable.

ABC, on the other hand, may not be able to pay off its current obligations using only quick assets, as its quick ratio is well below 1, at 0.45. The quick ratio and current ratio are accounting formulas small business owners can use to understand liquidity. While the quick ratio uses quick assets, the current ratio uses current assets. The current ratio formula is current assets divided by current liabilities. Quick Ratios are essential financial metrics that help businesses gauge their short-term liquidity and ability to meet immediate financial obligations.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. It only considers readily available assets and may not take into account other factors such as future prospects, timing of transactions, etc. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors.

A strong current ratio greater than 1.0 indicates that a company has enough short-term assets on hand to liquidate to cover all short-term liabilities if necessary. However, a company may have much of these assets tied up in assets like inventory that may be difficult to move quickly without pricing discounts. For this reason, companies may strive to keep its quick ratio between 0.1 and 0.25, though a quick ratio that is too high means a company may be inefficiently holding too much cash.

This means the business has $1.10 in quick assets for every $1 in current liabilities. It indicates that ABC Corp. may not have enough money to pay all of its bills in the coming months, having 85 cents in cash for every dollar it owes. Or, on the other hand, the company may have more options to manage its debt than the quick ratio indicates. For example, a liability may allow for variable times or forms of payment, or the company may have access to credit and refinancing options. For one, this ratio does not account for cash flows, which can have a significant impact on a company’s liquidity.

Although the Quick Ratio is above 1, it suggests that the company may face some challenges in meeting short-term obligations promptly. Manufacturing Company B could consider strategies to improve its liquidity, such as reducing inventory levels or optimizing accounts receivable management. The quick ratio and current ratio are two metrics used to measure a company’s liquidity.

The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. It has short-term liabilities such as debt payment, payroll and inventory costs due within the next 12 months in a total amount of $40 million. Comparing a company’s QR with industry peers and historical data provides a more comprehensive assessment.

Liquid assets are those that can quickly and easily be converted into cash in order to pay those bills. The quick ratio is more conservative than the current ratio because it excludes inventory and other current assets, which are generally more difficult to turn into cash. The quick ratio considers only assets that can be converted to cash in a short period of time.

The quick ratio can provide a good snapshot of company’s health, but it can also miss important issues. For example, the ratio incorporates accounts receivables as part of a company’s assets. This is important because leaving this information out can give a false impression, making the company seem financially weaker than it actually is. However, this depends on the company’s clients making their payments in a timely fashion. If a client doesn’t make their payments on time, the company may not have the cash flow that the quick ratio indicates.

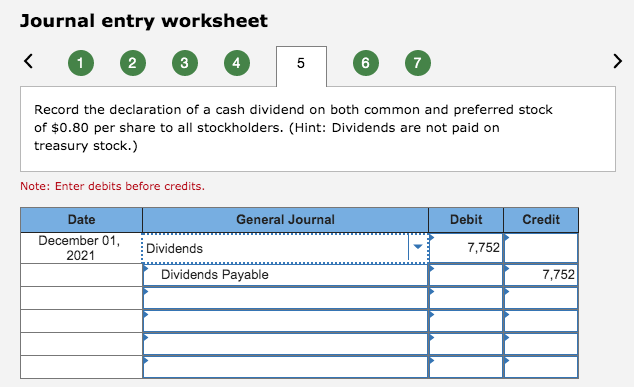

Journal Entries for Dividends Declaration and Payment

This journal entry is made to eliminate the dividends payable that the company has made at the declaration date as well as to recognize the cash outflow that is not an expense. Since accountants at Your Co. have already created the liability (Dividends Payable) and have not yet paid the cash dividend, no accounting financial statement is changed. The declaration date is the date on which the board of directors declares the dividend.

The Journal Entries

Cash dividends are corporate earnings that companies pass along to their shareholders. First, there must be sufficient cash on hand to fulfill the dividend payment. On the day the board of directors votes to declare a cash dividend, a journal entry is required to record the declaration as a liability.

How confident are you in your long term financial plan?

- However, the statement of cash flows will not show the $250,000 dividend as it has not been paid yet; hence no cash is involved here yet.

- The legality of a dividend generally depends on the amount of retained earnings available for dividends—not on the net income of any one period.

- All of our content is based on objective analysis, and the opinions are our own.

- Corporations experiencing growth generally are more likely to issue a stock dividend than stable, mature firms.

From a theoretical and practical point of view, there must be a positive balance in retained earnings in order to issue a dividend. The dividend payout ratio is the ratio of dividends to net income, and represents the proportion of net income paid out to equity holders. On the date that the board of directors decides to pay a dividend, it will determine the amount to pay and the date on which payment will be made. The major factor to pay the dividend may be sufficient earnings; however, the company needs cash to pay the dividend. Although it is possible to borrow cash to pay the dividend to shareholders, boards of directors probably never want to do that. Corporations experiencing growth generally are more likely to issue a stock dividend than stable, mature firms.

Large stock dividend

When the company makes the dividend payment to the shareholders, it can make the journal entry by debiting the dividends payable account and crediting the cash account. At the date the board of directors declares dividends, the company can make journal entry by debiting dividends declared account and crediting dividends payable account. The number of shares outstanding has increased from the 60,000 shares prior to the distribution, to the 78,000 outstanding shares after the distribution. The difference is the 18,000 additional shares in the stock dividend distribution. No change to the company’s assets occurred; however, the potential subsequent increase in market value of the company’s stock will increase the investor’s perception of the value of the company. A large stock dividend occurs when a distribution of stock to existing shareholders is greater than 25% of the total outstanding shares just before the distribution.

There is no change in total assets, total liabilities, or total stockholders’ equity when a small stock dividend, a large stock dividend, or a stock split occurs. A stock split causes no change in any of the accounts within stockholders’ equity. The impact on the financial statement usually does not drive the decision to choose between one of the stock dividend types or a stock split. Large stock dividends and stock splits are done in an attempt to lower the market price of the stock so that it is more affordable to potential investors.

The amount at which retained earnings is debited depends on the level of stock dividend, i.e. whether is a small stock dividend or a large stock dividend. A cash dividend is the standard form of dividend payout authorized by a corporation’s board of directors. These dividends are typically authorized for payment in cash on either a quarterly or annual basis, though special dividends may also be issued from time to time. It is at that time that the dividend becomes a liability of the corporation and is recorded in its books. Since there are 100,000 common shares outstanding, the total cash dividends will be $120,000.

They are ‘dividends’ in the sense that they represent distribution to shareholders. Companies issue stock dividends when they want to bring down the market price of their common stock. A stock dividend is a type of dividend distribution in which additional shares are distributed to shareholders, usually at no cost. These new shares are then traded on the same exchange at current market prices. If the company prepares a balance sheet prior to distributing the stock dividend, the Common Stock Dividend Distributable account is reported in the equity section of the balance sheet beneath the Common Stock account.

All of our content is based on objective analysis, and the opinions are our own. As this excerpt indicates, the management at General Electric Company has given considerable thought to the amount and timing of dividends. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

The total stockholders’ equity on the company’s balance sheet before and after the split remain the same. A traditional stock split occurs when a company’s board of directors issue new shares to existing shareholders what are marketable securities robinhood in place of the old shares by increasing the number of shares and reducing the par value of each share. For example, in a 2-for-1 stock split, two shares of stock are distributed for each share held by a shareholder.